Understanding the PAYE System Certification

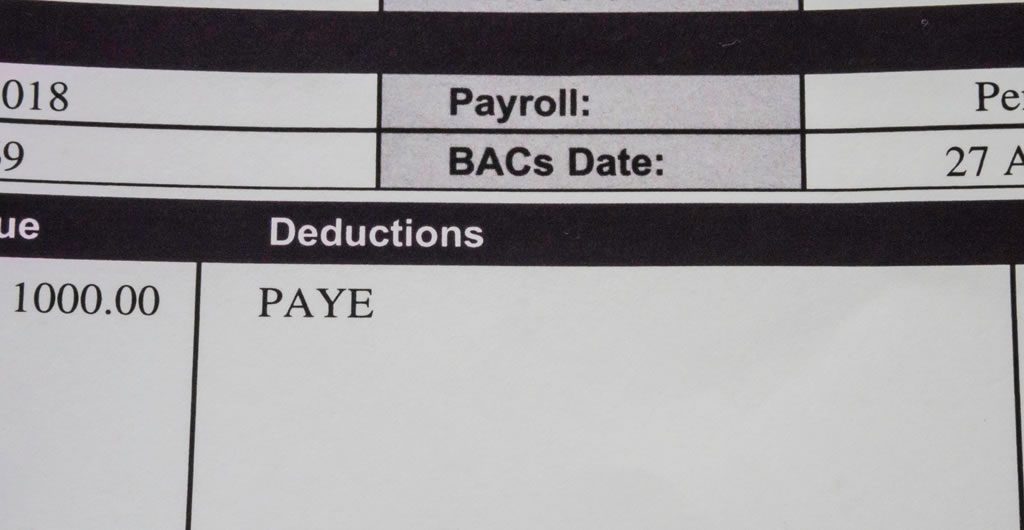

All workers and employers in the UK, including the self-employed, are part of the PAYE system. Introduced in 1944 by HMRC, it is designed to make the process of paying tax, National Insurance, and other deductions much simpler.

In this course, you will learn about how the PAYE system works, how tax codes ensure employers deduct the correct amount of tax from their employees’ pay, how self-employed people pay taxes, and the importance of using appropriate software to submit payment submissions.

You will learn:

- How the UK PAYE system works

- How tax codes work, and what the various tax codes mean

- How and when you need to send information to HMRC

- How to choose the best software to use to help manage your payroll

- How self-employed people navigate the PAYE system

Explore our full library of training courses.

Duration 0.50 hours

Duration 0.50 hours

Modules 5

Modules 5

Certificate of completion

Certificate of completion

All major browsers and devices

All major browsers and devices

This course is included as part of our multi-user learning packages.

This course is included as part of our multi-user learning packages.

Popular courses

Course FAQ

Who can take the Understanding the PAYE System Certification course?

There are no entry requirements to take the course.

What is the structure of the course?

The course has 4 modules and should take 30 minutes. Each module takes between 15 and 45 minutes on average to complete, although students can spend as much or as little time as they feel necessary on the modules.

Where / when can the course be studied?

The course can be studied at any time and from any internet-connected device.

Is there a test at the end of the course?

Once you have completed the course there is a multiple choice test. The questions will be on a range of topics found within the modules. The test, like the course, is online and can be taken at a time and location of your choosing.